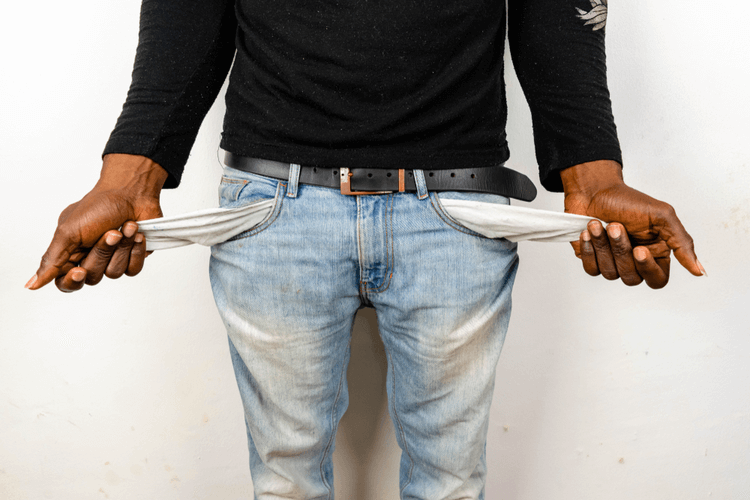

When Life Hits You Hard, Emergency Car Title Loans Can Help

At times, life can hit you with major financial stress, leaving you wondering what non-traditional loan options are available to you. Here’s when you should consider emergency car title loans.

When traditional loans are not an option, title loans Utah can get you back on your feet again if you’ve had an expensive emergency, securing you up to $15,000 in cash.

There are a number of situations where emergency car title loans through Utah Title Loans, Inc. can be of use, and knowing how to use them in an emergency can help you have peace of mind when times get tough. In this article, you’ll see how title loans Utah can relieve financial stress in any financial situation.

What Are Car Title Loans?

Emergency car title loans use your car’s title as collateral to secure the loan. Depending on the make, model, age, and condition of your vehicle, lenders can issue you a loan amount based on the value of your vehicle. In return, they will put a lien on your car title to ensure repayment.

This setup works well for lenders and borrowers since lenders incur less risk by securing the loan, and borrowers are usually able to secure higher amounts of money, better terms, and more favorable credit leniency on title loans.

When Are Title Loans An Option To Consider?

Utah title loans can be something you consider during a financial emergency. Put simply, in any situation, where leaving something unpaid detriments your health or your assets, title loans are valuable. You might also consider them during circumstances where unpaid bills could lead to significantly more expense down the line.

You might consider using one in these situations:

- Your car breaks down and needs urgent repairs

- Your home needs urgent pest treatment

- You have overdue bills to cover

- You need to travel for important business concerns

Car Repairs

Your car is one of your most important assets, and it’s a valuable resource you need to get to and from work. As such, when one of your cars breaks down, a title loan might be the right call to help you get repairs done right away, preventing further damage to your vehicle.

Pest Control Treatment

Any major concern that threatens the safety of your family or the stability of your home should be dealt with post haste. Pest control treatments aren’t cheap, but they’re extremely important, especially if you live somewhere that’s prone to termites or other home-destroying infestations.

Getting a title loan can alleviate the stress of having to pay for pest control treatments and let you defer that payment into more manageable chunks.

Overdue Bills

Whether you’ve been impacted by COVID-19 or some other life happenstance, the bills don’t stop coming, and if you’re trying to get back on your feet with a stable income again, then a title loan can help alleviate the stress of dealing with insistent creditors so that you can manage your payments in a more controlled setting.

Important Business Travel

Another good reason to consider emergency car title loans, your business is your livelihood, and missing out on an important business travel venture for the sake of cost isn’t good for your long-term goals. In this situation, you might choose to rely on emergency car title loans to cover travel costs.

The Step-By-Step Guide To Getting Title Loans Utah

If you need urgent cash for an emergency, then all you need to do is follow these simple steps to get a title loan from Utah Title Loans, Inc.:

- Fill out the online form provided on the website.

- Wait for a representative to get in touch with you and go over the details of a loan.

- Book an appointment to meet for a car inspection, either at the store or the location you choose.

- Bring your required items (car, lien-free title, and ID) to the meeting for the associate to inspect.

- Fill out the closing paperwork.

- Leave with your car and your money on the same day or the following business day.

The steps couldn’t be easier, and the friendly loan staff is on standby to help you with any questions you may have during the title loan approval process. Just make sure your car title is clear with no loans or judgments against it, your ID is valid and has a photo of you on it, and that you bring the car itself to your meeting.

Fill Out Our Online Form Today!

Concerned about your financial situation after an emergency? When life hits you hard, emergency car title loans are a resource you can consider to get immediate cash flow for important repairs or bills.

Title loans Utah is an option for you if you own your car outright, and getting started is as simple as filling out an online form. So, if you’re ready to manage that financial struggle head-on, consider applying today!

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.