How To Find A Lender For Emergency Car Title Loans

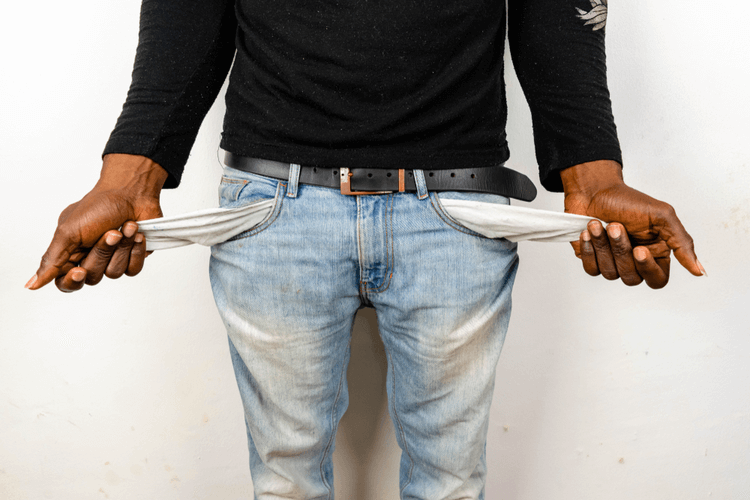

When you’ve got a financial emergency you can’t cover, you might be considering emergency car title loans. Here’s how to find a suitable lender for title loans Utah.

Utah Title Loans, Inc. offers convenient, straightforward title loans up to $15,000 to help you out of an emergency situation. The loan process takes as little as 30 minutes, and you can get started by applying online.

Turns out, finding the perfect emergency car title loans isn’t too difficult after all, especially when you rely on the experts at Utah Title Loans, Inc. In this article, we'll take a look at how you can find the right lender to get title loans in Utah.

Why Choose A Car Title Loan?

Emergency car title loans are a resource you can rely on if you need quick cash and own your car outright. As long as your car has no liens and is in your name, then you’re in good standing to apply for these loans.

You might consider searching for this type of loan if you have large expenditures to cover, unpaid medical bills to address, or repair costs to manage.

In an emergency, title loans are an option to consider, and Utah Title Loans, Inc. is on standby to facilitate the easy, simple loan you need.

Where To Start Looking

Once you know that a title loan is the right option for you, then your next step is to find a reputable direct lender. You can search for “title loan lenders in Utah” in your internet browser for the quickest way to find a list of lenders near you.

When you check out their websites, you should be able to identify a physical address and a phone number attached to the business. These are both indicators of an authentic lender that you can rely on. You should also be able to see positive reviews either on their website or third-party sites.

Negative reviews aren’t a good indicator that you can trust a direct lender.

Why Choose Utah Title Loans?

Utah Title Loans, Inc. is a title loans service company in Utah offering loans up to $15,000, which is a big chunk of money you can use for emergencies.

Their online request process can get you connected with a trusted representative right away, and best of all, you can choose the location for the representative to inspect your vehicle rather than having to visit a store location.

How To Apply With Utah Title Loans, Inc.

If you’ve decided that Utah Title Loans, Inc. is the right resource for your emergency car title loans, then your first step should be to apply using the secure online form.

This form sends your basic info to the nearest location, and you will receive a call soon after. During the call, your loan representative will discuss the terms of the loan, what you may qualify for, and what’s expected of you during the repayment period.

You’ll also schedule a meeting at a location of your choice if you’d rather not come to the store. At the meeting, make sure you bring along your required items, as the loan specialist will need to review them.

You’ll need the following to apply:

- Driver’s license or state-issued ID

- Lien-free vehicle title

- The vehicle itself for inspection

The representative will check your ID and car title, as well as consider the overall condition of the car and verify the VIN. They will assess everything and inform you whether you qualify for approval. If you are approved, congratulations! You can get the money you need for an emergency that same day or the next business day.

Title Loan FAQs:

Do You Keep Your Vehicle During A Title Loan?

Yes, you keep your vehicle during the title loan. The lender will hold onto your vehicle title while you are making payments, and you’ll get that back once the loan is repaid in full.

Can You Apply With Bad Credit?

Bad credit may impact your terms, but you can still apply with Utah Title Loans, Inc. even if your credit is bad or nonexistent.

Where Do I Need To Go To Get A Title Loan?

Emergency car title loans through Utah Title Loans, Inc. are available at stores around the state, but if you prefer, you can meet with a representative at a location you choose.

Apply Online Today!

Looking for a lender to cover your emergency car title loans needs? Utah Title Loans, Inc. has you covered. Their straightforward title loan process and helpful staff will walk you through every step of the way toward getting title loans Utah. Major life emergencies can hit you out of the blue, impacting your ability to live normally and devastating your savings.

In these circumstances, a title loan can help you get back on your feet, so if it’s the right choice for you, apply today!

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.