Surprising Things To Know About Inflation And Loans

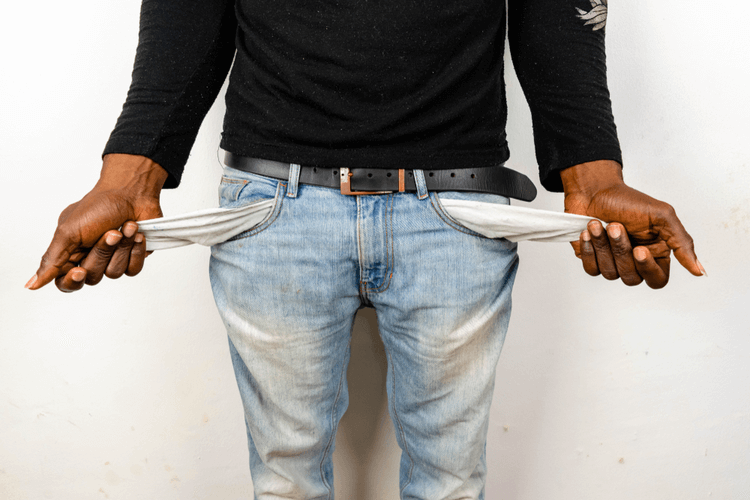

Every American is feeling the pinch of inflation, but Utah is getting punched in the gut. Most, if not all things are more expensive, especially basic goods. If you go to the supermarket, almost every item is 10% higher than before: meat, eggs, milk, diapers, you name it and the price tag proves it.

And don’t forget about gas, utilities, and rent. If you need to drive to work (and possibly drop off the kids at school or daycare on the way) you may see a huge chunk of your salary is used on fueling up the car.

So, is it this way all around the country? How does Utah compare to other states? What can you do when you’re short on cash? Here are some surprising facts about inflation and the loans that can help you get through this crisis.

Utah’s Inflation Rate Is Higher Than The National Average

While the national average inflation rate is 8.5% (already a record high), the Beehive state is getting numbers of 10.4% or more.

A recent report by the U.S. Congressional Joint Economic Committee that compared the cost of living in the last two years found that prices have increased by almost 15%. That’s almost double than the impact of inflation on states like Nebraska, Wisconsin, and New Jersey.

Gas Is Almost 50% More Expensive

While fuel prices in the US are generally going down, Utah isn’t as lucky. Gas is now 48% higher than last year, and that’s actually one reason why other basic goods and services are more expensive. It’s hitting consumers and businesses who have no choice but to raise prices to make any kind of profit.

You Could Be Paying Around $800 More Every Month For Basic Needs

Because inflation affects food, gas, and rent more than any other area, the average Utah resident could be shelling out up to $881 more just to cover basic needs.

That’s why people are trying to cut back. They’re switching to cheaper brands or cutting out some purchases completely. At grocery stores, you’ll see half-empty carts and people making painful choices about what they can do without.

9 Out Of 10 Utah Residents Are Concerned About Inflation

Inflation has become so bad that it’s alarming even for people who have stable incomes. A recent poll found that 9 out of 10 Utahns are “deeply concerned” about the prices, and have been forced to make big changes in their lifestyle and budget.

Unfortunately, for many, it’s not even a question of ‘Can I afford to dine out?” but “Where can I get the money to buy food and groceries for the month?” Inflation and loans are their top concerns.

States That Used To Have The Lowest Cost Of Living Are Most Affected

Ironically, Utah was one of the states with the lowest cost of living, so why does it now have the highest prices in the country? A report by the Economic Innovation Group says that it’s actually a nationwide trend.

Traditionally, the Pacific, New England, and Mid-Atlantic states have higher prices than the Heartland and Southern States. Today, it’s reversed: states like Utah, Mississippi, Idaho, and Iowa are the worst hit by inflation, while those with a higher cost of living have been able to stabilize their prices.

People More Vulnerable To Financial Emergencies

To no surprise, there’s a correlation between Utah inflation and loans: with everyone’s budget stretched to the limit, any urgent, unexpected expense can quickly escalate into a financial emergency.

Fortunately, help is just a click away. Utah Title Loans, Inc. provides an easy way for anyone to apply for a loan, and get emergency cash in just a few days.

Inflation And Loans—The Answer Is Here

It’s not the first time that Utahns have survived a crisis; the first pioneers didn’t have many resources, but they survived and thrived, and you will too. Right now, you just have to weather the storm, and while doing so, a title loan can help.

A title loan is a loan where you use your vehicle title as collateral. You can borrow from $300 to $15,000, depending on what kind of vehicle you have, its age, and its current condition.

Unlike bank loans, you don’t have to have a high credit score or meet income or employment requirements to qualify for a car title loan. You just have to be a registered owner of the car which is not currently being used as collateral for other loans (the title must be lien-free).

If you have a lien-free title in your name, then we can help you with the rest. Our request process is designed to be fast and convenient, so you will never have to wait for the emergency money you need.

- Simple requirements. All you need is a government-issued ID, a lien-free vehicle title, and a vehicle inspection.

- Online application. To get started fill out the inquiry form on our homepage and a representative will call you to explain the title loan process and answer your questions.

- Fast processing. Go to the nearest branch for the vehicle inspection and the verification of documents. This will only take about 30 minutes.

- Fast payout. If you’re approved you get the money the same day or the next business day.

If you have any questions or concerns about inflation and loans, contact us and we’ll be happy to help!

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.