Why Are Online Car Title Loans Perfect For Cash Emergencies?

Getting car title loans online has never been easier and thousands have used this resource in the last few months. But why are people using title loans for cash emergencies? Is it really the best solution?

We’re diving into five of the top reasons people prefer car title loans to other sources of money, including:

- A lack of American savings

- Unexpected global and local events

- Low or no credit scores

- Taking advantage of their vehicle

- Getting cash fast

So, let’s dive in to find out more.

Why People Use Car Title Loans Online

1. They Don’t Have Enough Savings.

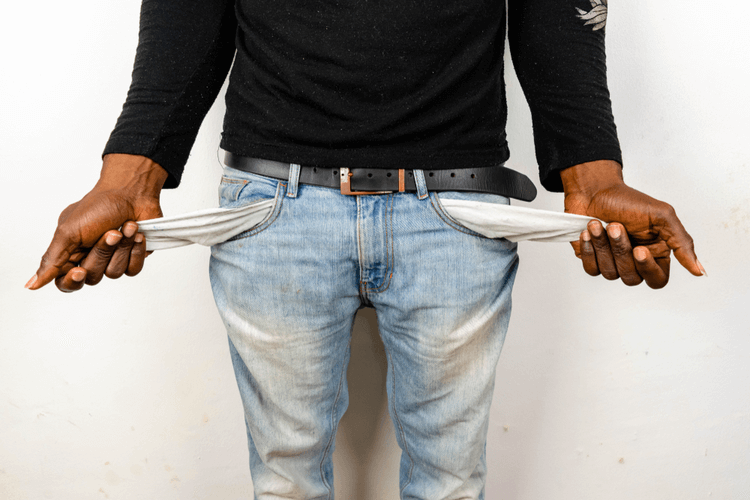

As of October 2022, the American savings rate hit a 17-year low of just 2.3%. Many families aren’t saving a dime, instead facing rising monthly costs with no increase in salary.

Some of us have been lucky enough to live off the surplus of pandemic financial assistance and savings from the bear market of the last decade, but times have shifted. There are not enough savings to go around.

If you don’t have an emergency fund, we encourage you to begin one as soon as possible. Even putting away $10 per week – or per month – will slowly accumulate and provide a cushion for when things get rough.

Until then, many folks are turning to car title loans online to cover the gap between their income and their expenses, especially when an unprecedented bill arrives in the mail.

2. They Face The Unexpected.

The economy has switched over the last year and continues to do so daily. Markets are down, up, then down again. Inflation keeps rising and interest rates follow. There is war in Europe and a potential financial crisis looming in China. We don’t know what to expect when we turn on the news.

As if global happenings weren’t enough, many people face unexpected challenges day to day. A car breaks down. The doctor calls with unsettling test results. Your relative in another state gets sick. A storm arrives and pushes a tree through your home’s roof.

Emergencies happen, and if you’re not prepared financially, car title loans online could provide the assistance you need – fast.

3. Their Credit Is Low Or Non-Existent.

Borrowers who need cash fast have few options. They could ask relatives or friends for money, which borders a fine line between utilizing the relationship and risking it.

Alternatively, they may try to apply for a personal loan from their local bank to no avail. With a long list of requirements, a high credit score is at the top of the list with little wiggle room.

Utah Title Loans, Inc. wants to give all borrowers a fair chance, which is why we don’t require good, fair, or existing credit to apply for our car title loans online.

4. Their Car Is An Asset.

If your car is paid off, congratulations! You own an asset and this asset could be used to back up your ability to repay a loan. If you don’t have good credit, a strong income history, or even a bank account, your car could be the key to accessing the money you need.

Some assume you shouldn’t risk your assets for a loan, and our car title loans online agree. That’s why we let you keep your car, drive it, and maintain it as you normally would during the loan. Your car will only leave your side if you decide to stop repaying your loan.

5. They Need Cash Fast.

Whether you need $300 or $15,000 or somewhere in between, Utah Title Loans, Inc. has your back. We know that bills don’t wait and that your financial emergencies won’t understand a delay because you’re waiting for a loan decision.

To avoid this, our loan request process can be started from home, with ease. Once that’s done, you’ll find out the next steps to qualify and receive your money all within the same day or the next business day.

How To Use A Car Title Loans Online For Cash Emergencies

You’ve learned the top five reasons so many people depend on car title loans online, so you may be wondering how the title loan process works.

First, you’ll need your car, its lien-free title, and your I.D. Complete the form on our homepage and wait for a call from us. A representative from your area will guide you through our loans, how they work, and the steps you’ll take to make repayment.

Then, you’ll meet with this same rep in person either at your home, our office, or anywhere in between. We truly work with our customers to make things as easy as possible for them.

In person, we’ll review your car and documents and determine your potential loan amount. If eligible, you can receive your emergency money that same day or the following business day.

It’s Time To Get Your Title Loan

Car title loans online are available now for people across Utah. Hundreds or even thousands of dollars are ready to help you pay for that financial emergency. All you need is your car, its title, and your I.D.

What are you waiting for? That bill won’t wait, so neither should you! Fill out our online inquiry form today.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.