What Are Payday Loans?

Are you in need of a loan and wondering what are payday loans? Payday loans happen to be one of the fastest and easiest types of loans to apply for. Payday loans are not complicated to understand and are just as uncomplicated to apply for.

As long as you have a source of income and the proper documents needed to apply, you may find that a payday loan is the loan you are looking for. If you find yourself asking “what are payday loans”, you can find out all you need to know below.

What is a Payday Loan?

A payday loan is a loan given to individuals that essentially acts as an advancement of your next paycheck. They are typically made for small amounts of money that the borrower would otherwise have come their next paycheck.

As payday loans act to bridge the gap between one paycheck and the next, they are expected to be paid back come payday. As such, they are referred to as a short-term loan option for those who need fast cash.

What are Payday Loans Used For?

Now that you can answer the question of “what are payday loans”, you may be wondering how they are used.

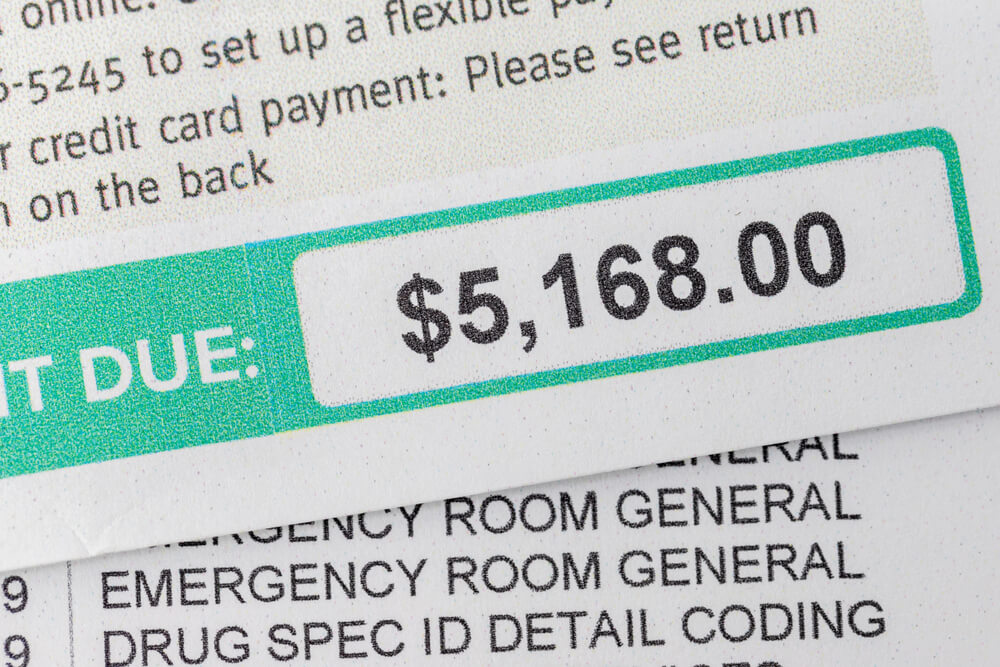

What is a payday loan used for? In short, emergencies. Most people get paid weekly, or bi-weekly. If you are self-employed, you may not get paid for several weeks depending on your line of work. Whatever the case, emergencies that require immediate funds often cannot wait until your next payday.

Even for those who get paid weekly, time-sensitive situations can be financially pressing. For example, think about if your main source of transportation broke down and needed immediate repair work. How would you get back and forth to work to receive said paycheck and not lose hours? This is but one example when it comes to answering what is a payday loan used for. Other emergencies that may call for a payday loan are:

- Medical bills

- Rent

- Utility bills

- Unexpected travel

- Home repairs

What are the Requirements for Payday Loans?

Payday loans do not require a massive number of documents to apply and get approved. In fact, they only require three documents. First and foremost, you need to provide a lender with proof of income.

Proof of Income

As mentioned above, payday loans are essentially an advancement of your next paycheck. To get that advancement, you will need to show them proof of how much you make.

This will very likely be in the form of your most recent paycheck. Without a current paystub, your lender will not be able to estimate how much you qualify for.

A Blank Check

You will also need to provide your lender with a blank check from an active checking account in your name. This will be used by the payday loan provider come your next payday. They will cash it to meet and close out the terms of your loan agreement.

Identification

As with any loan application requirement, you will need to show identification to your lender. Acceptable forms of identification include a driver’s license or state-issued I.D.

It must show you are 18 years or older. It must also match up with the name on the most recent paystub supplied to your lender.

Where to Get a Payday Loan and How

Where you get a payday loan can turn the ‘how’ of ‘how to get a payday loan’ into an easy-going and quick experience.

Utah Title Loans, Inc.

Utah Title Loans, Inc. doesn’t just offer title loans, they also provide their customers with payday loans. If bridging the gap between paychecks is what you are looking for, you can get anywhere from $100 to $500 in a payday loan amount.

Speak with a Loan Representative

With Utah Title Loans, Inc., you will find experienced loan representatives that can assist you every step of the way. During your first conversation, they will make sure you understand how the application process works and answer any questions you may have.

The application process is so simple you can get approved in as little as 30 minutes! You can even get the funds you are approved for as soon as the same day you apply or the following business day. The application process is as simple as:

- Contact your local Utah Title Loans, Inc. facility by phone or by submitting an online form to have a representative call you.

- Speak to the representative about the application process and confirm the required items.

- Bring the required documents to the store to have them verified and complete the application paperwork.

- Find out if you are approved, how much you are approved for, and set up payment options.

Find Out Today

Now that you know “what are payday loans”, find out how much you can qualify for. Submit an online form today with Utah Title Loans, Inc. as the first step to getting the funds you need A.S.A.P.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.