Wondering how do payday advance loans work? Find out exactly what they are, how do they work, and how easy it is to obtain one in Utah!

Read More >>

Looking for solutions to how to build credit fast? Learn proven methods to build credit quickly and achieve financial goals with these 6 easy ways.

Read More >>

Struggling with urgent emergency costs? Get emergency financing without the wait with payday loans from Utah Title Loans, Inc.

Read More >>

Has a financial emergency thrown a wrench in your financial roadmap? Learn how a title loan can help you afford the cost and achieve financial clarity!

Read More >>

Need emergency cash today? Learn about payday loans and signature installment loans. Decide which same-day cash loan can help you best!

Read More >>

Looking to improve your credit score fast? Learn five of the best ways to build credit quickly. Discover how you can get a payday loan with bad credit!

Read More >>

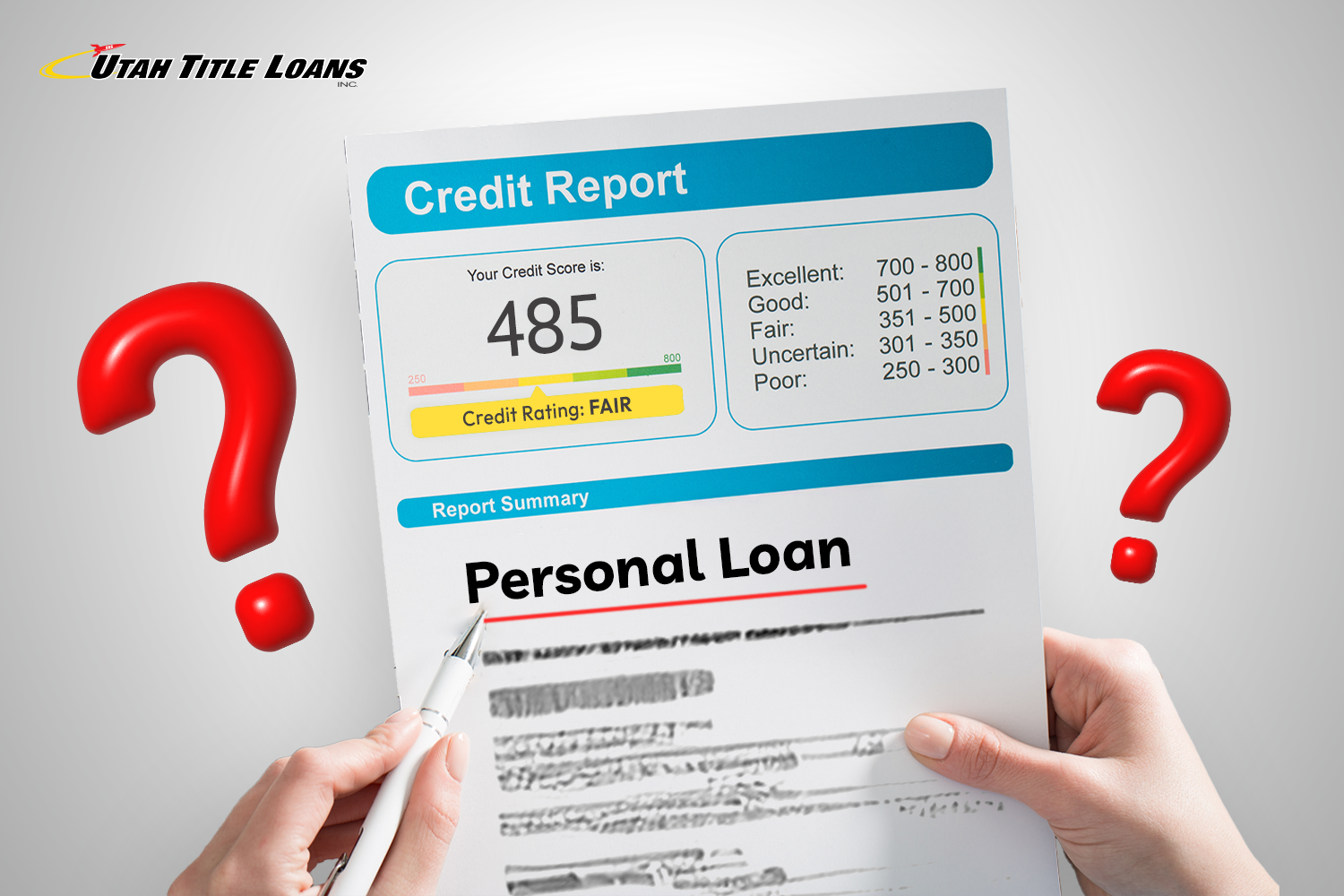

Learn about how a personal loan can affect your credit score. Discover the positive and negative influences of personal loans on credit. Borrow bad credit loans with Utah Title Loans, Inc.!

Read More >>

Do you need a personal loan but worry about the credit score impact? Learn how a personal loan affects your credit score positively!

Read More >>

Learn more about the richest towns in the United States, such as Scarsdale, NY, and Los Altos, California, and the richest towns in Utah, like Highland, UT.

Read More >>

Thinking about refinancing your home loan in Utah? This guide explains why you should refinance your home loan and what steps you need to take.

Read More >>