Wondering how do payday advance loans work? Find out exactly what they are, how do they work, and how easy it is to obtain one in Utah!

Read More >>

Looking for solutions to how to build credit fast? Learn proven methods to build credit quickly and achieve financial goals with these 6 easy ways.

Read More >>

So you need a second quick cash loan? Learn why you need to repay your first loan before borrowing again. Discover how to get title loans, payday loans, and installment loans with us!

Read More >>

Need emergency funds but have bad credit? Learn how to get title loans for bad credit in Utah with Utah Title Loans, Inc.

Read More >>

Do you have bad credit but need an emergency loan? Learn about installment loans for bad credit and how to qualify for same-day cash!

Read More >>

Struggling with urgent emergency costs? Get emergency financing without the wait with payday loans from Utah Title Loans, Inc.

Read More >>

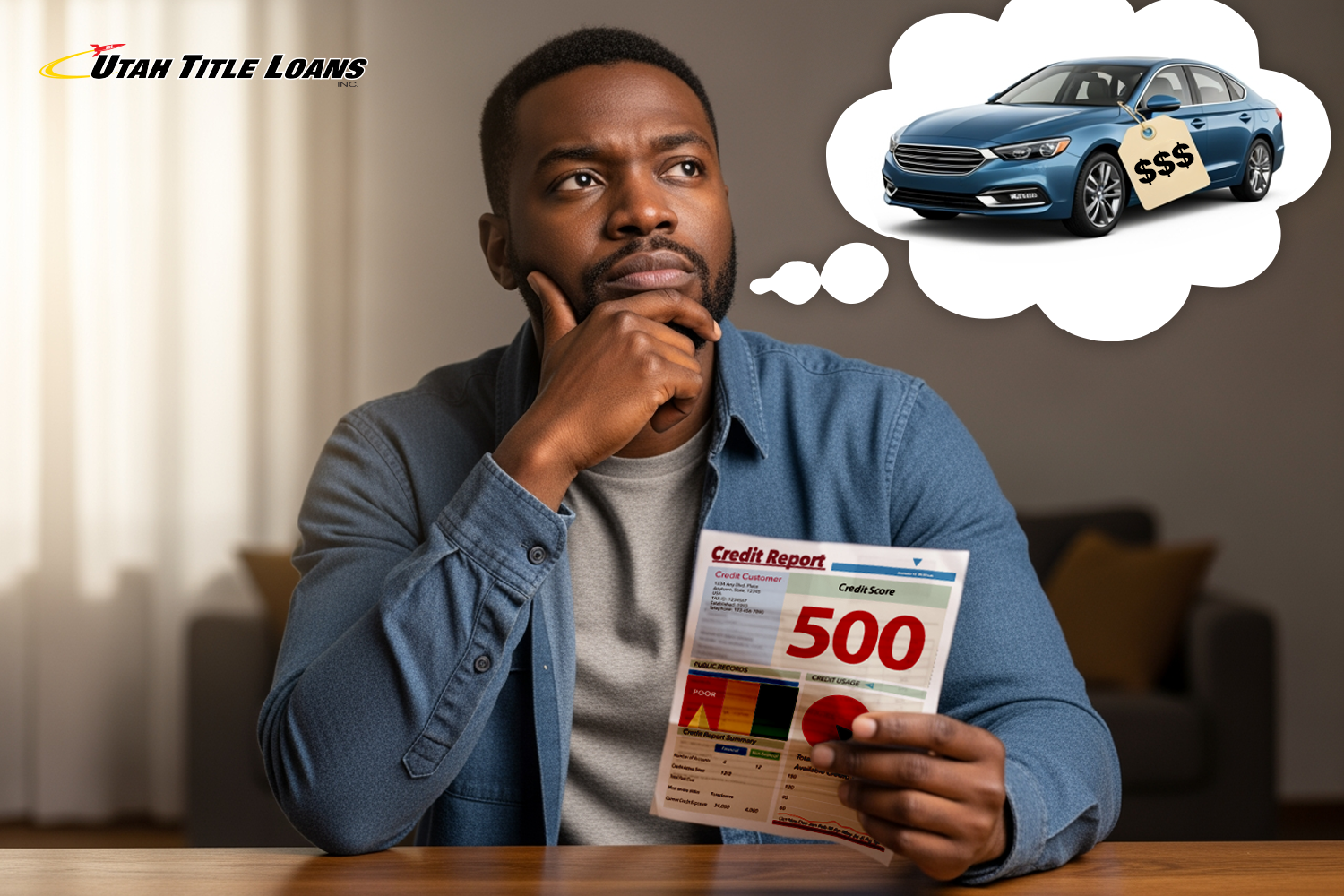

Has a financial emergency thrown a wrench in your financial roadmap? Learn how a title loan can help you afford the cost and achieve financial clarity!

Read More >>

Need emergency cash today? Learn about payday loans and signature installment loans. Decide which same-day cash loan can help you best!

Read More >>

Looking to improve your credit score fast? Learn five of the best ways to build credit quickly. Discover how you can get a payday loan with bad credit!

Read More >>

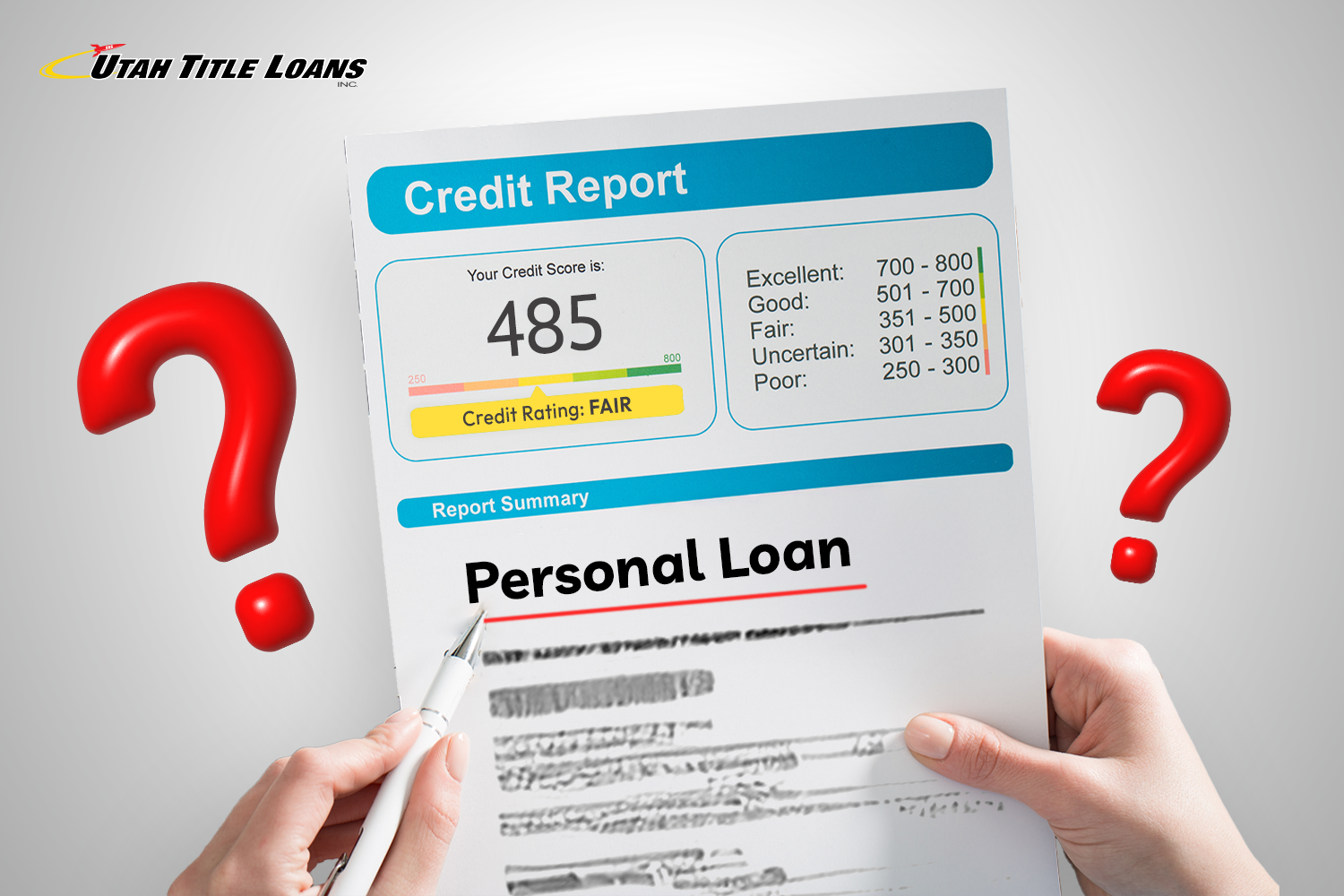

Learn about how a personal loan can affect your credit score. Discover the positive and negative influences of personal loans on credit. Borrow bad credit loans with Utah Title Loans, Inc.!

Read More >>